Introduction

Financial statements serve as the heartbeat of any business, providing a comprehensive snapshot of its financial health. For small businesses, understanding these statements is crucial for informed decision-making and sustainable growth.

Types of Financial Statements

Financial statements come in three main forms: the Balance Sheet, the Income Statement, and the Cash Flow Statement. Each plays a unique role in painting a complete picture of a business’s financial position.

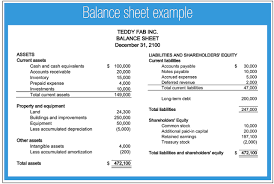

Understanding the Balance Sheet

The Balance Sheet outlines a business’s assets, liabilities, and equity. Assets represent what the business owns, liabilities signify its debts, and equity reflects the owners’ investment.

Decoding the Income Statement

The Income Statement delves into a business’s revenues, expenses, and net income. It showcases the company’s profitability over a specific period.

Navigating the Cash Flow Statement

The Cash Flow Statement breaks down a business’s cash inflows and outflows through operating, investing, and financing activities. It provides insights into a company’s liquidity and financial flexibility.

How Small Businesses Benefit

Financial statements empower small businesses in decision-making, attract potential investors, and assist in planning for sustainable growth.

Common Financial Ratios

Liquidity, profitability, and solvency ratios help assess a business’s financial health. These ratios offer valuable insights into a company’s operational efficiency and financial stability.

Importance of Accuracy

Ensuring the accuracy of financial data is paramount for reliable decision-making and compliance with regulatory requirements.

Tools for Creating Financial Statements

Utilizing accounting software or seeking professional assistance can simplify the process of generating accurate and timely financial statements.

Challenges in Interpreting Financial Statements

Small business owners may face challenges in understanding the complexities of financial statements, but overcoming the learning curve is essential for effective financial management.

Tips for Small Business Owners

Regularly monitoring financial statements and seeking professional advice are critical practices for small business owners to ensure financial success.

Case Study: Successful Implementation

Examining a real-life example showcases the positive outcomes that result from the successful implementation of robust financial reporting practices.

Future Trends in Financial Reporting

Technology integration and streamlined processes are expected to shape the future of financial reporting, making it more efficient and accessible for small businesses.

FAQs

- What are financial statements? Financial statements are comprehensive reports that outline a business’s financial position, performance, and cash flows.

- How often should small businesses update their financial statements? Regular updates, preferably monthly, help small businesses stay on top of their financial health.

- Can financial statements help secure a business loan? Yes, lenders often require financial statements to assess a business’s creditworthiness before approving loans.

- Are there industry-specific considerations in financial reporting? Yes, certain industries may have unique accounting practices and reporting standards.

- What role do financial statements play in tax planning? Financial statements provide crucial information for tax planning, helping businesses optimize their tax liabilities.

Conclusion

In conclusion, understanding financial statements is a cornerstone for the success of small businesses. By mastering these reports, entrepreneurs can make informed decisions, attract investors, and pave the way for sustained growth. Regular monitoring, professional assistance, and adaptation to emerging trends will ensure that small businesses not only survive but thrive in today’s competitive landscape.